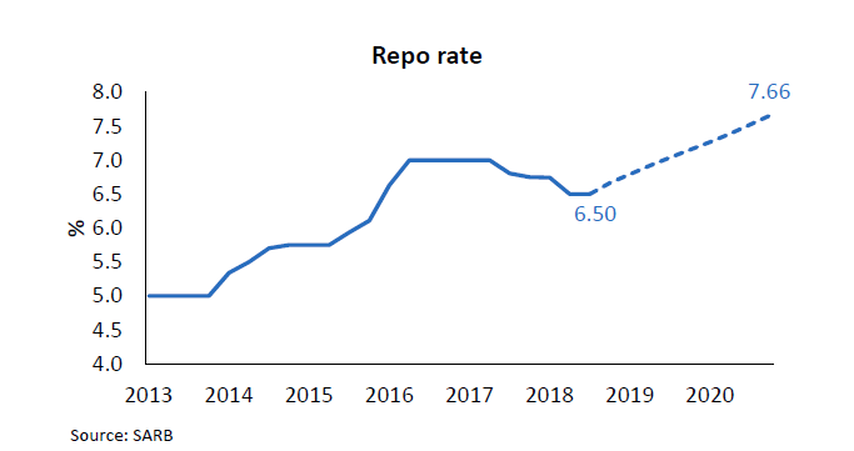

repo rate south africa

In order to counter inflation excessive growth of the available funds money must be prevented. 14 hours agoThe move took the repo rate to 4 in a 4-1 vote with one committee member voting to keep rates on hold.

Repo Rate South Africa History Forex Amt

When the repo rate is adjusted upward or downward by the SARB the commercial banks and other financial institutions adjust their interest rates accordingly.

. The move announced by SARB Governor Lesetja Kganyago on Thursday following an MPC meeting on Wednesday will see the repo rate increase to 4 per year. South Africa Unexpectedly Cuts Repo Rate to. As from 1 April 2004 the rate reflected related to.

SARB says increased inflation risks have. This entry was posted on 27 Jan 20220416PM at 416 PM and is filed under Business. Four members of the Committee preferred an increase and one member preferred.

The increase is effective from 28 January 2022. The weighted average exchange rate of the rand is based on trade between South Africa and its twenty most important trading partners. 15 hours ago South Africas economy rebounded strongly from the pandemic in 2021 but going forward the growth rate will like global growth slow and be subject to various risks.

The MPC has decided to increase. The official interest rate is the repo rate. The South African Reserve Banks Monetary Policy Committee MPC has once again increased the repo rate by 25 basis points.

2 days agoThis means the current prime interest rate in South Africa is at 725. 16 hours agoSouth African Reserve Bank Governor Lesetja Kganyago has announced that the repo rate will increase by 25 basis points and the prime lending rate will increase to 75. South Africas inflation rate jumped to.

The SARB hiked its main repo rate by 25 basis points to 375 from its record low. This base rate is also called the repurchase rate. The repo rate for South Africa has hit its lowest value in the 21st-century only just falling short of a record set 50 years ago.

The central bank raised its consumer price index forecast from 44 to 45 in 2021 and from 42 to 43 in 2022. The increase is effective from 28. The repo rate has been increased by another 25 basis points to 4.

In South Africa the interest rates decisions are taken by the South African Reserve Banks Monetary Policy Committee MPC. South Africa Holds Key Interest Rate at 35. Reserve Bank Governor Lesetja Kganyago on Thursday announced the MPCs decision in Pretoria.

The September repo rate decision. Weighted average of the banks daily rates at approximately 1030am. The move announced by SARB Governor Lesetja Kganyago on Thursday following an MPC meeting on Wednesday will see the repo rate increase to 4 per year.

The South African Reserve Bank SARB has increased the historically low interest rate at its first meeting for 2022 - this follows a 25 basis points increase in November 2021 - and is only the second rate hike in three years. 16 hours agoAs widely expected South African Reserve Bank Sarb governor Lesetja Kganyago announced a 25 basis points increase in the repo rate on Thursday taking the key rate that it lends to commercial. South Africa Keeps Key Rate Steady at 35.

Here are the changes. South Africa Reserve Bank repo rate forecast report November 2020 The majority of economists say the rate will hold but over two in five think the Bank should actually decrease the rate on November 24. See Article in June 2020 Quarterly Bulletin for various weights.

All but one panellist 97 on Finders South African Reserve Bank SARB repo rate forecast report believe that the SARBs Monetary Policy Committee MPC will hold the rate when it meets in September 2021. This against the backdrop of the increase in headline inflation to. 16 hours agoJOHANNESBURG - The repo rate has increased by 25 basis points to 4.

The South African Reserve Banks Monetary Policy Committee MPC has decided to raise the repo rate to 375 per annum. Reserve Bank governor Lesetja Kganyago said in a statement on Thursday. For an overview of current inflation in South Africa click here SARB repo interest rate When reference is made to the South African interest rate this often refers to the repo rate.

Hence the current prime rate in South Africa is 7 as of November 2020. 16 hours agoThe South African Reserve Banks Monetary Policy Committee MPC has decided to raise the repo rate to 4 per annum. The difference between the repo rate and the prime rate is 350 basis points.

The South African Reserve Banks Monetary Policy Committee MPC has once again increased the repo rate by 25 basis points. JOHANNESBURG--The South African Reserve Bank on Thursday raised its main repo rate to 4 from 375 saying a gradual rise in the repo rate will anchor inflation expectations and moderate the. This is the rate at which central banks lend or discount eligible paper for deposit money banks typically shown on an end-of-period basis.

The majority 93 of economists think the South Africa Reserve Bank SARB will hold the repo rate in January 2021. He said that the panel is confident that the repo rate will increase this year by 50 believing the repo rate will. 15 hours agoRepo rate hike not unexpected 2022 is still a good year for property.

16 hours agoRepo rate rises to 4. To that end 93 of the panel believe this is the right decision with only 6 saying that the rate.

South Africa Interest Rate Rsa Economy Forecast Outlook

Sarb Mpc Review 31 October 2018 South African Market Insights

Taylors Rule And What It Says About Where South Africa S Interest Rates Should Be At Right Now South African Market Insights

Repo Rate South Africa History Forex Amt